Not known Incorrect Statements About Guided Wealth Management

Not known Incorrect Statements About Guided Wealth Management

Blog Article

Not known Details About Guided Wealth Management

Table of ContentsThe Main Principles Of Guided Wealth Management Examine This Report about Guided Wealth Management8 Simple Techniques For Guided Wealth Management5 Simple Techniques For Guided Wealth ManagementAn Unbiased View of Guided Wealth Management

The advisor will establish up a possession allotment that fits both your threat tolerance and risk ability. Possession allowance is simply a rubric to identify what percent of your overall financial portfolio will be distributed across various asset courses.

The ordinary base income of a financial advisor, according to Without a doubt as of June 2024. Any individual can function with a financial advisor at any age and at any phase of life.

Guided Wealth Management - Questions

If you can not afford such help, the Financial Planning Organization may have the ability to aid with for the public good volunteer help. Financial consultants benefit the customer, not the business that utilizes them. They should be receptive, ready to clarify monetary principles, and keep the customer's ideal passion at heart. If not, you need to search for a new expert.

An expert can recommend feasible enhancements to your strategy that may aid you achieve your objectives much more effectively. Finally, if you don't have the moment or rate of interest to manage your financial resources, that's one more good factor to employ an economic consultant. Those are some basic reasons you could require an expert's specialist help.

Search for an expert who concentrates on educating. An excellent economic advisor should not simply market their solutions, but provide you with the tools and resources to end up being monetarily savvy and independent, so you can make educated choices by yourself. Choose an advisor who is informed and knowledgeable. You desire an expert who remains on top of the financial extent and updates in any kind of location and that can address your economic inquiries regarding a myriad of topics.

The Ultimate Guide To Guided Wealth Management

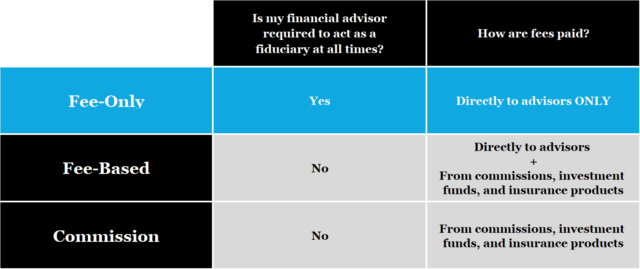

Others, such as certified monetary planners(CFPs), already stuck to this standard. But also under the DOL regulation, the fiduciary requirement. financial advisor brisbane would certainly not have actually related to non-retirement recommendations. Under the viability standard, financial experts commonly deal with payment for the products they market to customers. This indicates the client may never obtain an expense from the economic consultant.

Fees will likewise differ by location and the advisor's experience. Some advisors may use lower prices to aid clients who are simply starting with economic planning and can't pay for a high month-to-month price. Normally, a financial expert will provide a totally free, preliminary appointment. This consultation offers an opportunity for both the customer and the expert to see if they're a great fit for each other - https://penzu.com/p/f981e05d8bb23c42.

A fee-based expert may gain a fee for creating an economic plan for you, while likewise earning a compensation for offering you a certain insurance policy product or investment. A fee-only monetary consultant earns no payments.

The Basic Principles Of Guided Wealth Management

Robo-advisors don't need you to have much cash to obtain started, and they set you back much less than human economic consultants. A robo-advisor can not speak with you about the finest means to obtain out of financial obligation or fund your youngster's education.

A consultant can aid you figure out your savings, how to develop for retired life, assistance with estate preparation, and others. Financial experts can be paid in a number of ways.

The 7-Minute Rule for Guided Wealth Management

Marital relationship, separation, remarriage or simply moving in with a brand-new partner are all milestones that can ask for cautious preparation. For instance, along with the usually hard emotional ups and downs of divorce, both companions will need to handle vital financial factors to consider (https://www.provenexpert.com/guided-wealth-management/). Will you have sufficient revenue wealth management brisbane to support your way of life? How will your financial investments and other assets be separated? You might quite possibly require to change your financial approach to keep your goals on course, Lawrence claims.

An unexpected increase of cash money or possessions increases immediate concerns concerning what to do with it. "A financial consultant can aid you think via the means you could put that money to function toward your personal and monetary goals," Lawrence states. You'll wish to think of just how much can go to paying down existing financial obligation and just how much you could consider investing to go after an extra protected future.

Report this page